Philanthropy is coming of age in the Middle East, where donors are increasingly looking for strategic ways to channel their funding. Here's our pick of the giving trends to watch over the next 10 years.

The decade ahead promises to be an exciting one for Arab philanthropy. Regional donors, already known for their generosity, are gaining global profile as they embark on innovative new projects and partnerships. Short-term charitable gifts are slowly giving way to more transparent and planned giving strategies, and Gulf nations including the UAE and Kuwait are beginning to influence policy and drive new agendas in areas including humanitarian aid and the combat of preventable disease.

Developments in technology, meanwhile, have been instrumental in changing how aid is delivered within the region as well as how money is raised. Evolutions in both Islamic finance and sharia-compliant giving are unlocking new project funding and creating novel ways for organisations and individuals to bolster humanitarian and development work.

Beyond these factors, the Covid-19 pandemic that has swept the world has delivered a crash course in the need for a joined-up international response to global challenges. The virus has created a raft of emergency needs, and the wider social and economic effects are still to be fully realised. Almost overnight, the pandemic has given new weight to the role philanthropy plays on the world stage, and the impact of this will be felt for years to come.

The 2020s look poised to usher in more strategic philanthropy and collaboration, more innovative funding instruments and further focus on giving with impact on a global scale. Finally, as a new generation steps up to take the reins in family offices, there will be fresh opportunities to put the region’s wealth to work for good. As the new decade gets underway, here’s our pick of some of the giving trends to watch.

TRENDS

01

WIDENING THE LENS

02

SPOTLIGHT ON HEALTH

03

UNITED FRONT

04

FAITH AND FINANCE

05

BEYOND THE BOTTOM LINE

06

IMPACT IN ACTION

07

MEETING THE SDGS

08

A NEW GUARD

09

GREEN GOALS

10

DO BUSINESS, DO GOOD

01.

WIDENING THE LENS

Arab philanthropists are donating at historically high rates, but this has gone hand-in-hand with pressure to prioritise giving to domestic causes and charities. Against a backdrop of falling oil prices and shrinking government budgets, donors have increasingly been pressed to turn their philanthropy inward, often through giving to state-backed charities. In addition, funds remain tied to a handful of cause sectors, with areas such as climate change and gender equality receiving a fraction of the capital given to education and health.

Giving from the region’s wealthy expatriates also leans heavily homewards, channelled through private foundations in their countries of origin or in donations to aid appeals. Business leaders based in the GCC have pledged millions of dollars in the wake of floods and weather events in India, Pakistan, and the Philippines, in addition to sending shipment of clothes and other support items. It is tricky to quantify the impact of this giving, which is often done on an ad-hoc and unplanned basis.

Over time, this domestic focus may prove a barrier to the type of bold and catalytic giving needed for breakthrough social change. A shift is needed, both in terms of cause areas and initiatives, if donors are to chip away at issues such as growing inequality and youth joblessness, which cross borders. The coronavirus pandemic, which in the space of months has wreaked health, economic and social chaos around the world, has underscored the need for united action. Arab donors will want – and need – to be part of that globalised response to find a vaccine, reset the world economy and support society’s most vulnerable.

As the region’s philanthropic ecosystem matures, we predict a widening divide between funders pursuing more innovative ‘big bet’ initiatives and those who will continue to give along familiar and charitable lines. Longer-term, we also see potential in the creation of aggregated giving vehicles, able to marshal resources, respond to global emergencies and give strategic donors access to a robust marketplace of causes.

02.

SPOTLIGHT ON HEALTH

Gulf donors are major supporters of the fight against polio, malaria and neglected tropical diseases, conditions that largely affect people living in poor and marginalised communities. In addition to hefty financial donations – Sheikh Mohammed bin Zayed, the Crown Prince of Abu Dhabi, has personally donated more than $250m to stamping out guinea worm, polio and other diseases – the region looks set to ramp up its contribution to frontline healthcare delivery and scientific research, marking its emergence as a key player in global public health. This trend is especially timely, against the backdrop of the Covid-19 epidemic, which has affected countries worldwide.

Abu Dhabi has recently launched the Global Institute for Disease Elimination (GLIDE), to help galvanise existing efforts to erase polio, malaria, river blindness and lymphatic filariasis. The centre plans to convene on-the-ground experts and assist with research and strategies, expanding the role Abu Dhabi is carving out for itself in public health.

Meanwhile, Community Jameel, the philanthropic arm of Saudi Arabia’s Abdul Latif Jameel Group has co-funded J-IDEA, or the Abdul Latif Jameel Institute for Disease and Emergency Analytics. Based at Imperial College London, the centre combines cutting-edge data, science and public health research and has been a central player in the global response to Covid-19.

Funding for preventive healthcare also looks to be tracking upwards. As an example, in the space of just a few years, Gulf donors – public and private – have sunk $51m into the global vaccine alliance Gavi, a public-private partnership backed by the Bill & Melinda Gates Foundation that funds immunisation programmes for poor nations.

In April, Saudi Arabia announced it would be giving $150m to both Gavi and the Coalition for Epidemic Preparedness Innovations (CEPI) for Covid-19-related response and vaccine development. Meanwhile, Kuwait, Saudi Arabia, the UAE, Qatar and Oman are all expected to be among the nations pledging substantial new sums of money to Gavi at its upcoming funding conference, planned for June.

“Compared to a decade ago, there is much deeper engagement in the region and strong buy-in from governments and other stakeholders around immunisation,” says Faisal Gilani, senior partner for resource mobilisation and private sector partnerships at Gavi.

Gilani predicts deeper collaboration as the decade gets underway, including a possible Gulf-based crowdfunding tool to direct Islamic giving to Gavi, and vaccine production within Saudi Arabia, as part of the alliance’s efforts to swell pharmaceutical markets and keep immunisation prices low.

03.

UNITED FRONT

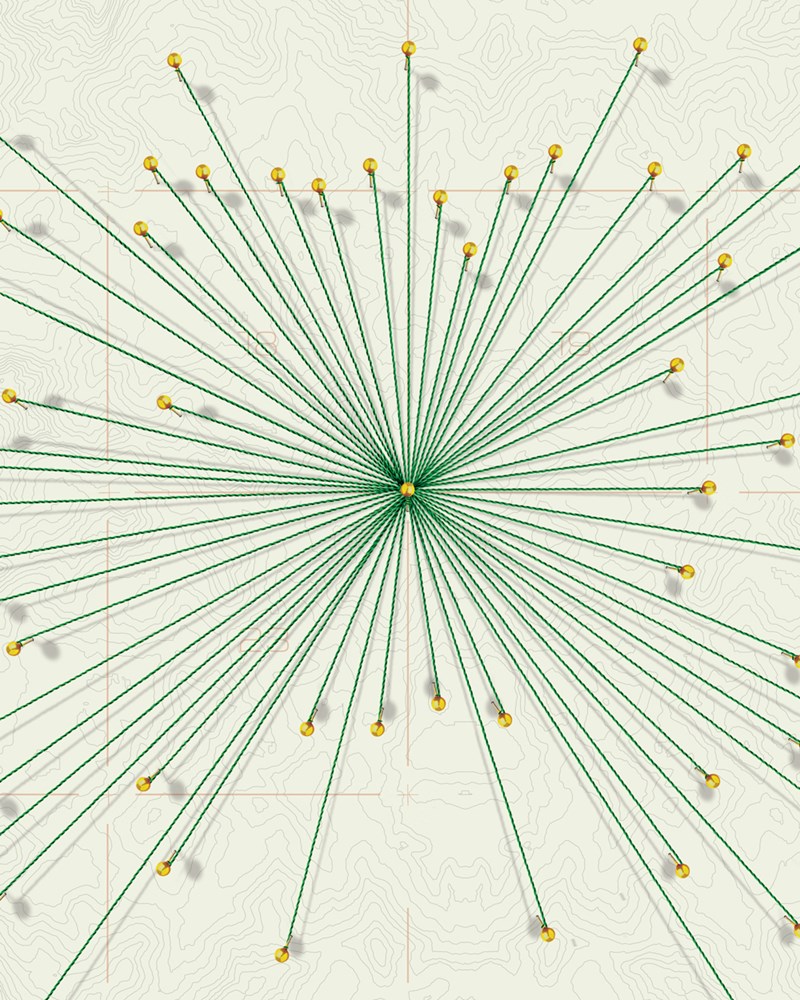

Good philanthropy is rarely a solo sport. For donors hoping to make headway on society’s biggest problems, collaboration is essential to success. In the coming decade, we predict an uptick in Arab philanthropists teaming up to pool expertise, time and resources, in an effort to turbocharge their impact.

It will be a step change for Arab giving, which has a long tradition of discreet and direct gifting, delivered in isolation. This approach, which often sees money given in a vacuum without clear insight into where it is most needed, creates a fragmented donor landscape and raises the risk of duplicate programmes. By contrast, collaborations are an opportunity to bring expertise, money and relationships together for good. They offer benefits such as more cash for causes, less spend on overhead, access to networks and the opportunity for different sectors to pull together for widespread change. In giving circles and peer networks, philanthropists can share knowledge and experience and gain new expertise.

Green shoots have already emerged. In Saudi Arabia, Khaled and Olfat Juffali have formed the Shefa Fund, a first-of-its-kind donor collaboration platform that seeks to channel funds to support the health of children and families in the Middle East and beyond. In the UAE, philanthropists including the Varkey family have supported the launch of a GCC philanthropy network designed to boost the impact of giving in the region. Meanwhile Nexus, a global philanthropy network that targets the offspring of wealthy and influential families, opened a Middle East and North Africa chapter in 2017. Its aim is to help next generation millennials to drive sustainable and scalable social change.

Seven GCC-based donors have also signed the Giving Pledge, a campaign led by two of the world’s richest men, Bill Gates and Warren Buffet, in which billionaires promise to give at least half their fortunes to charity. Pledgers gain access to a global circle of philanthropists, alongside a calendar of peer-to-peer learning sessions and expert resources.

We expect this trend towards collaboration to grow through the next decade, as donors become bolder in their giving ambitions and seek out new opportunities and approaches.

04.

FAITH AND FINANCE

New technology has accelerated the race to tap Islamic giving, with a growing number of sharia-compliant giving platforms and digital fundraising channels set to change how Muslims donate and to whom.

Practising Muslims are obliged to give 2.5 per cent of their wealth each year for the benefit of the poor, destitute and needy, under one of the five pillars of Islam known as zakat. Islamic finance institutes must give a portion of their profits and make ‘purification payments’ if they benefit from non-sharia compliant deals. These payments, as well as others such as sadaqah and waqf, add up to one of the largest forms of charitable wealth transfers in existence. Some estimates place the global pot at $1trn annually – an eye-catching target for cash-strapped aid and development agencies facing ever-growing caseloads.

Among the new initiatives is the Global Muslim Philanthropy Fund for Children (GMPFC), a partnership between UNICEF and the Islamic Development Bank (ISDB). A first of its kind, the fund allows multiple forms of Muslim philanthropy, including zakat and Islamic endowments, to be used in emergency response and development programmes for children living in Organisation of Islamic Cooperation (OIC) nations.

The fund’s inaugural commitment came from Emirati philanthropist Abdul Aziz Abdulla Al Ghurair, who pledged $10m to support refugee education programmes. The King Salman Centre for Humanitarian Aid and Relief (KS Relief) meanwhile will be collaborating with UNICEF and the ISDB with fundraising activities targeting philanthropists in Saudi Arabia, the first time the UN agency has undertaken such activities within the kingdom.

UNHCR began collecting zakat donations online in 2016, before last year launching the rebranded Refugee Zakat Fund to funnel alms to refugee and displaced families in the Middle East and beyond. In 2019, the fund raised more than $43m; donations that were disbursed in the form of cash aid and through the provision of needs and services.

Also in the pipeline is a collaboration between the Responsible Finance Investment (RFI), an Islamic Finance think-tank based in the UK, and the Global Fund, an international partnership mobilising funds to fight HIV, TB and malaria. Its aim will be to leverage corporate zakat from Islamic banks to deliver high-impact programmes for refugees and displaced populations worldwide.

Elsewhere, other agencies are turning to innovative finance tools to win over Muslim investors and donors. Since 2014, the global vaccine alliance Gavi has issued three sukuks worth a total of $750m, equivalent to almost half its funding commitments over that time period. Cyrus Ardalan, chair of the board of the International Finance Facility mechanism at Gavi, says the vaccine bonds have helped diversify its investor base into a key market in the Middle East.

“Vaccine bonds are supporting something which has a clear, unambiguous social benefit,” he explains. “This is something… that is very consistent with sharia philosophy.”

Another example comes in the form of the One WASH Fund, which was unveiled in late 2019 with a target of slashing cholera deaths by 90 per cent in OIC member states. A partnership between ISDB and the International Federation of Red Cross and Red Crescent Societies, the fund blends Islamic finance contributions, such as zakat, sadaqah and waqf with traditional donor financing, but will be pre-funded through a sukuk to allow it to operate at scale from the get-go.

As global organisations seek to harness Islamic giving to plug their financing gaps, we can expect the Arab region to be the focus of innovation and initiatives in this space.

05.

BEYOND THE BOTTOM LINE

The global swing towards purpose over profits is gaining traction in the Middle East. While the region’s companies have long had deep pockets – consultancy firm Strategy& estimates the GCC’s top 100 family firms alone plough at least $7bn into philanthropy each year – CSR has often been more about good marketing than good business. This is changing, according to Dima Alashram, head of sustainability advisory services at the UAE-based Sustainable Square, who reports a leap in firms keen to sharpen the impact of their efforts.

“More and more companies are telling us they want to move away from basic charity and one-time donations or events, towards creating programmes with clear change indicators that allow them to measure long term impact,” she says. “It’s about more than just feeling good by giving money, but rather seeing where it actually goes and how it has an impact - not just on the community but also on their wider business.”

Among those banging the drum for sustainability is Pearl Initiative, a UAE-based business network that lobbies for transparency and accountability among Gulf firms – including in their philanthropy – arguing that good governance drives profit. At the same time, high-profile regional names such as DP World and Aramex are blazing a trail with well-crafted CSR strategies that align with and drive their corporate values.

Local financial markets are also playing a part in promoting better business. The Abu Dhabi Securities Exchange (ADSE), the Dubai Financial Market (DFM), the Boursa Kuwait, and Saudi Arabia’s Tadawul have all partnered with theUN’s Sustainable Stock Exchanges Initiative, which encourages companies to divulge their social and environmental impact. The UAE has gone a step further: in 2018, it unveiled a national index for the tracking, steering and reporting of CSR contributions, alongside the promise of perks for top-performing firms.

In March, an initiative launched by Abu Dhabi’s Authority of Social Contribution (Ma’an) in part to raise funds for those affected by the coronavirus, raised more than $27m in its first five days. Much of the funding came from corporations. It’s a trend that holds enormous potential, since corporate capital could do far more to combat the Arab region’s most complex challenges than philanthropic dollars alone.

But what would jolt more firms into action – and ensure good business is the expectation, rather than the exception – is a move to a top-down approach to social responsibility, a shake-up expects say is in the pipeline. “So far, the approach in the region has been to encourage and reward investing in CSR and disclosing on performance, rather than imposing fines or sanctions on those that don't,” Alashram explains. “But important steps are being taken in this area. We hope to see regulations that increase accountability on sustainability and CSR disclosures.”

06.

IMPACT IN ACTION

The 2020s will bring a surge in savvy investors putting their capital to work for good, further blurring the line between philanthropy and finance. Impact investing has already grown to a $502bn global market, driven by individuals and companies seeking innovative ways to fuel both financial and social gains, and slows little sign of slowing. The impact of the Covid-19 epidemic is also likely to seed new opportunities, as funds move to limit the fallout from the virus.

“I think that there is a growing understanding that this money could achieve bigger impact,” says Abdullah Al Nabhan, Middle East regional director at Palladium, a global impact management consultancy. “People want to know their money is being used in a positive and impactful way.”

Globally, family foundations have taken the lead, armed with both the funds and the flexibility to pursue innovative models. More than a quarter worldwide dabble in impact investment to some degree, according to a 2019 report from UBS and Campden Research, a trend that bodes well for the Middle East’s family-dominated private sector.

Al Nabhan sees particular appetite for impact investment in the GCC and says several funds are in development to tap what is an increasingly lucrative market. “It will take time for these funds to launch, but once we’ve had some successes, I think that will build momentum,” he says. “Then there will be a push to upscale and involve family offices and regional conglomerates, who will see these as new opportunities for both financial and social returns.”

One such tool due to launch in the UAE this year is a Social Impact Bond (SIB), a payment-for-results style contract that will be administered by Ma’an, the Authority of Social Contribution at Abu Dhabi’s Department of Community Development. The SIB, set to be the first of its kind in the Gulf, will use its capital to fund community projects with fixed social outcomes over three to five years. If the targets are met, investors will be paid back with an added return.

In Palestine, a Development Impact Bond (DIB) is already underway. Managed by the World Bank and launched in late-2019, the initiative aims to address high levels of youth unemployment in Gaza and the West Bank, where three out of five of the country’s nearly 40,000 annual graduates remain jobless.

It is the bank’s second DIB but its first related to job creation. It will work by mobilising upfront capital to pay for training schemes to help new graduates enter the workforce. The investors – the European Bank of Reconstruction and Development, the Palestine Investment Fund, a Chile-based private investment fund Semilla de Olivo, and FMO (the Netherlands Development Finance Company) – receive a dividend if participants complete their training and score a job.

Impact investing is an opportunity for individuals, corporates and family offices to align their portfolios and their values. We predict a more rapid adoption of this approach over the decade, especially as the next generation shoulders more leadership responsibility.

07.

MEETING THE SDGS

The UN’s 2030 sustainable development goals (SDGs) are a set of 17 targets for making the world a better place. They encompass every facet of life, from ending poverty and protecting the environment, to improving access to education and creating economic equality. Since their launch in 2015, the SDGs have grown to become a planning tool for businesses, governments, donors and nonprofits, and as momentum builds up to the 2030 deadline, we believe that the goals will take a bigger role in shaping policy and spending.

“The SDGs are a good guidance framework,” explains Medea Nocentini, co-founder and CEO of Dubai-based social enterprise accelerator Consult and Coach for a Cause (C3). “It’s about aligning to the challenges that affect the whole globe. A few years ago, only a few people were talking about them, but now they are a widespread term.”

Spend is starting to reflect this. Between 2010 and 2015, $34.3bn was spent by foundations on global initiatives aligned with the objectives of the SDGs. However, in the first three years following the SDG’s formal launch, the allocation increased to $39.8bn annually, according to SDGfunders.org, a dashboard tracking donor flows towards SDGs, funded by the Conrad N. Hilton Foundation, Ford Foundation, and the MasterCard Foundation.

Despite this, the amount still required to meet the 2030 goals is estimated to be in excess of $2.5trn and the impact of the Covid-19 pandemic will only inflate this figure. Enter philanthropy, say policymakers, who are keen to tap not just funding but also to seed disruptive solutions to social, environmental and economic problems that fall through the gaps of formal governments.

Making the case for Middle Eastern philanthropic capital to be pivoted towards SDG-linked projects, Badr Jafar, CEO of the UAE’s Crescent Enterprise, and patron of the newly-launched Centre for Strategic Philanthropy at Cambridge Judge Business School, says: “Where philanthropic capital fills a market gap, and is focused, measurable and scalable, it can create real system change.”

08.

A NEW GUARD

More than $15.4trn in assets will be transferred between generations during the next decade, according to a 2019 study by Wealth-X, a global data and analysis consultancy. In the Gulf region, where family offices and foundations dominate the giving landscape, this unprecedented shift will make major waves.

As the new generation of Gulf philanthropists take the reins of their family fortunes, we can expect to see more focus on transparency around how funding is allocated as well as a rising awareness about the important of measuring impact and outcomes.

“Arab philanthropists and young Arabs in general have an intrinsic sense of social purpose and entrepreneurialism that perhaps earlier generations did not,” notes Clare Woodcraft, former CEO of the UAE’s Emirates Foundation, and the newly appointed executive director of the Gulf-backed Centre for Strategic Philanthropy at Cambridge Judge Business School.

“What we’re seeing now is a second, even third, generation saying to the founding fathers, as it were, that the way they want to deploy philanthropic capital is going to be different to how it was in the past,” she says. “They are looking at models that are more entrepreneurial…and this is a very interesting and exciting trend for the region.”

Mohammed Raafi Hossain, a Dubai-based Islamic fintech specialist who is currently working on a new giving platform in collaboration with the Global Fund, says he believes the handover from the old to the new generation within family officers creates new scope for higher quality giving. “This newer generation is much more in tune and more aware about the concept of quality giving and strategic impact measurement,” he adds.

Myrna Atalla, executive director of AlFanar, the Arab region's first venture philanthropy organisation, has also noted a change. “The older generation is motivated by the end goal of their giving, but the new generation is more motivated by the tools,” she says.

09.

GREEN GOALS

As the fallout from climate change continues to dominate global agendas, we predict the environment will become a new area of focus for Arab philanthropists and businesses. There is already strong backing for renewable energy within GCC governments. The UAE, which hosts the International Renewable Energy Agency (IRENA), recently unveiled the Abu Dhabi Climate Initiative, a campaign seeking to combine technology and innovation to tackle climate challenges.

The state-financed Abu Dhabi Fund for Development (ADfD) has to date financed global renewable energy and development projects valued at more than $4bn. In Saudi Arabia, the Saudi Industrial Development Fund has begun offering loans for clean energy projects, and the government has also announced several new renewable power initiatives aimed at shrinking the country’s dependence on oil.

Despite this leadership at the government level, companies in the region have to date shown little interest in environmental causes. According to a May 2019 study published by Sustainable Square, a Dubai-based consultancy firm, just 11 per cent of the 1,500 firms surveyed across 18 Middle East and North Africa countries cited the environment as a priority for their CSR.

However, as climate-related disasters continue to grab headlines - and issues closer to home such as growing water scarcity and mass displacement become more prevalent - donors may be forced to rethink their priorities.

The coronavirus pandemic has only underlined the need for more a globalised response to challenges, like climate change and disease, that pay little heed to formal borders.

Change may already be afoot. The 2020 Knight Frank Wealth report, published in March, found three quarters of the Middle East’s super-rich indicated they “were becoming more worried about the impact of climate change”. More than half said they felt that from a PR perspective, it was “important to be seen to be taking action on climate change”.

According to a February 2020 report by Oliver Wyman, a management consultancy, failing to act on climate change will cost the world $26trn by 2030. That is more than 10 times the $2.5trn required to meet the SDGs over the next decade and makes a strong case for the value of upfront, pre-emptive investment.

10.

DO BUSINESS, DO GOOD

At the other end of the scale to big-ticket businesses, social entrepreneurship is set to bloom into the next decade. The Middle East is home to a growing number of initiatives promoting social startups, many of which offer incubation support to fledgling enterprises.

Among them is RISE Egypt, a self-described ‘think and do tank’ that helps growth-stage social enterprises scale up by connecting them to investors and other networks. In Saudi Arabia, the King Khalid Foundation runs social entrepreneurship track that offers grants, mentorship and full incubation to entrepreneurs seeking to turn their ideas into impact

Another is Dubai-based Consult and Coach for a Cause (C3). Founded in 2012, it began providing support services for emerging start-ups and SMEs, but has since evolved into a social impact accelerator supported by global banking giant HSBC. From 40 UAE applications and six finalists in its first acceleration round in 2017, C3 in 2020 received more than 600 applications from eight countries.

“The growth has been exponential”, says Medea Nocentini, the organisation’s CEO and co-founder, adding that venture capital firms were increasingly scouting C3 events looking for new targets. “Investors have finally realised that doing good makes business sense.” – PA